The Formula of My 'Someday' Fund

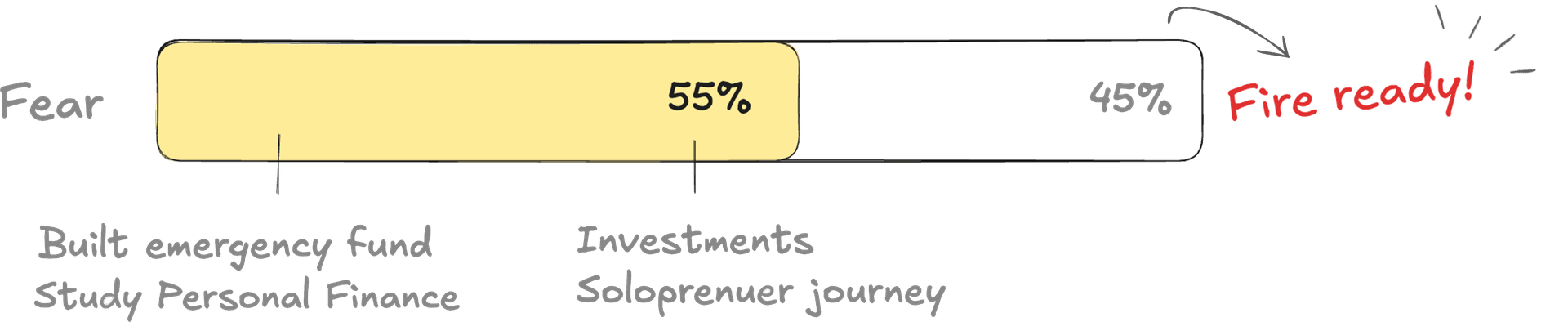

As of this writing, I'm excited to share that my FIRE journey has reached the 55% mark! It's been quite a ride, and I've finally cracked the code on the right investments for me. Not only that, but I've also taken my first steps into the world of solopreneurship. While there's still a long road ahead, I'm excited about the progress I've made. But let's rewind a bit and talk about how I discovered the basic formula for my "someday" fund, the foundation of my FIRE strategy.

My Progress...

"Confusion comes from having too many options. Simplicity comes from knowing your priorities." — Unknown

When I started my personal finance journey, I felt overwhelmed by the amount of information available. Books, courses, articles there's so much content out there that it's easy to get confused. Everyone seems to have their own strategy, and it's enough to make your head spin. Some say real estate is the key to wealth, others swear by business, and there are those who champion stock picking. While each approach has its own merits, the conflicting advice left me unsure of what would work best for me.

Interestingly, while I'm working towards getting prepared incase I got fired again. Little did I know, I am using the same framework to prepare for "FIRE" (Financial Independence, Retire Early)

What is FIRE?

FIRE is a philosophy that encourages aggressive saving and investing to retire early. The goal is to be financially independent, meaning your money works for you, not the other way around. When you achieve FIRE, you no longer rely on a job for income, your investments and savings cover your living expenses. It's about having enough to maintain your desired lifestyle without needing a salary every year.

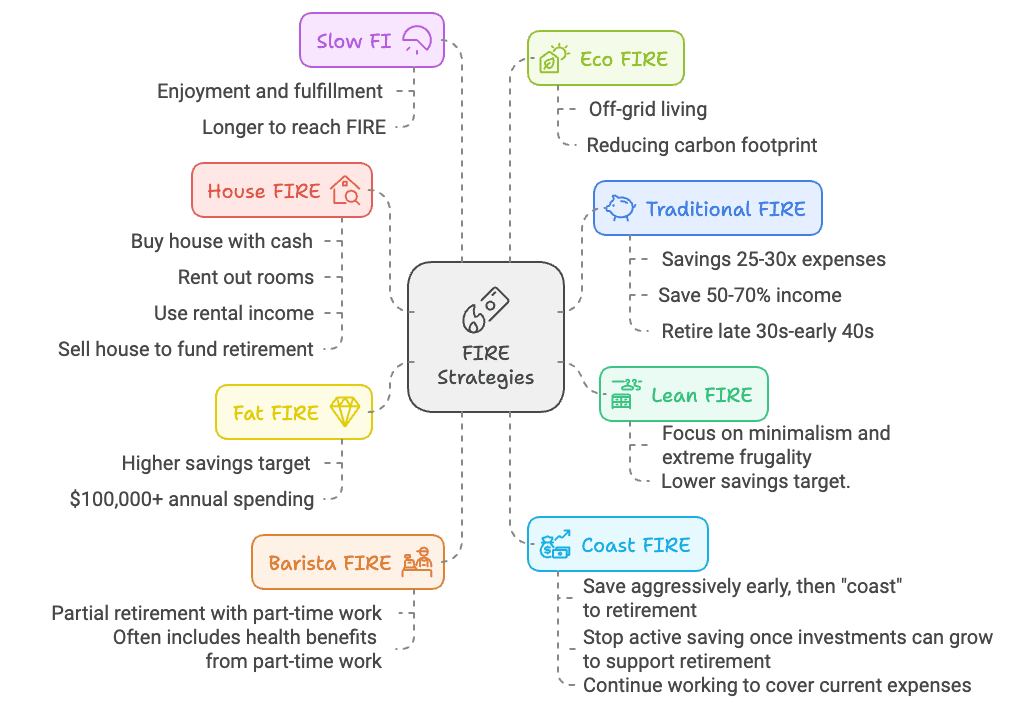

The beauty of FIRE lies in its flexibility. It's based on your own expenses, meaning the lower your costs, the sooner you can retire. On the flip side, if your expenses are higher, you can still retire, but it will just take longer. There are various types of FIRE to explore, from Traditional FIRE to Lean FIRE, Fat FIRE, Coast FIRE, and more. Each approach fits different lifestyles and financial goals (see Figure 1 for a breakdown of these FIRE strategies).

Figure 1: FIRE Strategies

Figure 1: FIRE StrategiesSlow Path to FIRE

Early in my journey, I adopted the Traditional FIRE method, aiming to save 25 times my annual expenses. For example, if my monthly expenses are ₱70,000, that's ₱840,000 a year. Multiply that by 25, and I'd need a FIRE fund of ₱21 million.

However, I later discovered a different strategy that better aligns with my net worth, cash flow, and skillset. This new approach could shorten my working years but demands more discipline in managing both my finances and my time. I will create a new post about this since this topic is not related to this post.

Saving the Right Way

Once you've calculated your retirement goal, the next step is to save and invest aggressively. Many people fall into the trap of saving what's left after expenses, which is a formula for failure:

Formula for failure:

Income - Expenses = Savings

Correct formula is:

Income - Savings = Expenses

In other words, you need to pay yourself first. Save and invest before spending on anything else. If your expenses are tight after saving, the solution is to find a way to increase your income.

I came across a blog by Mr. Money Mustache, where he discusses the relationship between working years and savings rate. For instance, if you want to retire in 5–10 years, your ability to achieve that depends on two main factors:

"How much you save each year (your savings rate) "

"How much you can live on (your spending level)"

The Simple Math That Can Change Your Life

If you're spending 100% of your income (or more), you'll never be prepared to get FIRE and will work for the rest of your life, unless someone else is saving for you (e.g., wealthy parents or winning the lottery). On the other hand, if you manage to spend 0% of your income, you can stop working already.

Below is a table showing how many years you'll need to work based on different savings rates, starting from zero net worth.

| Working Years Until Retirement | Savings Rate |

|---|---|

| 66 | 5% |

| 51 | 10% |

| 43 | 15% |

| 37 | 20% |

| 32 | 25% |

| 28 | 30% |

| 25 | 35% |

| 22 | 40% |

| 19 | 45% |

| 17 | 50% |

| 14.5 | 55% |

| 12.5 | 60% |

| 10.5 | 65% |

| 8.5 | 70% |

| 7 | 75% |

| 5.5 | 80% |

| 4 | 85% |

| 3 | 90% |

| 2 | 95% |

| 0 | 100% |

Source: Working years vs. Savings Rate, click here to networthify.com.

What's surprising to see is how just a small change in your savings rate can drastically cut down the number of years you need to work. For example, increasing your savings rate from 10% to 15% could allow you to retire 8 years earlier! That is 8 years of goodbye to your demanding boss or sayonara to your daily commute and early mornings! If you aim to stop working in 10.5 years, a savings rate of 65% will get you there, only a few can spend only 35% of expenses and save 65%. But if you have a target year on when you want to stop working and do what you love, the formula is right there in front of you.

Personally, I use this tracker to automatically check my average savings rate per month, and even track my spending and networth. It helps me a lot to be disciplined.

⭐ Net Worth Tracker and Monthly Spending Planner with Dashboard

Fast Path to FIRE

As seen in the table, low savings rates mean you'll need more years to reach FIRE or your Someday Fund. Even at a 65% savings rate, it would still take 10.5 years to retire, which may feel slow for some.

That's where the solopreneur journey comes in. This path isn't for everyone, but with consistency and discipline, you can reach FIRE faster. My goal isn't to become the next Zuckerberg or Musk; I just want to generate more income so I can achieve FIRE sooner. For instance, if my monthly expenses are ₱80,000 and my side business brings in ₱40,000 a month, I'm already halfway there. If I grow that business to ₱80,000 a month, I could technically retire without needing to rely on a paycheck anymore.

For example, let's say I start an e-commerce business selling a single product at ₱540 each. If I manage to sell just five items a day, I'd be earning ₱2,700 daily, or roughly ₱80,000 a month. This may sound like a lot, but when broken down into small daily goals, it feels more achievable. Of course, there are overhead costs to consider, but the point is, it's possible to build up additional income streams to fast-track your FIRE journey. What I love about solopreneur journey? you can start small and it's low-risk and high-reward.

My Strategy: A Balanced Approach

My strategy combines both slow FIRE and fast FIRE. I still rely on my primary income while building my business quietly on the side. If the business takes off, I can reach FIRE faster. If it doesn't, I still have a steady income and can continue saving and investing.

The challenge, of course, is staying disciplined. This journey won't be easy, but I'm confident it's the right path for me.

Even though this post seems like it's about money, it is not. It is about "time" and "freedom". Anyone can achieve financial independence with the right discipline and consistency. The beauty of the FIRE philosophy is its flexibility. You don't need to win the lottery, become a billionaire, or earn a six-figure salary. It's all about lifestyle choices and simple math. And the good news is,numbers don't lie. Instead of asking, “How should I spend my money?” the better question is, “How should I spend my time?”

☕ My top tools for investment and personal development:

- ⏰ Timeboard: A simple productivity hack to help you achieve more in less time.

- 📈 The Financial Minimalist PH: The right way to master personal finance.

- 🔥 Commerce Playbook: Your cheat sheet for e-commerce. Launch your business in days, not months!

💻 Follow my journey to getting FIRE READY

Join 1000+ corporate rebels who are done playing by the old rules and steal how I start crafting my escape plan.

Get 10 hacks for free about personal finance, investment, and soloprenuer ideas.

I'd love to hear your corporate story! email me at thecorporateslavegotfired@gmail.com