What does compound interest really mean?

"Success is the sum of small efforts, repeated day in and day out." — Robert Collier

The Tale of Three Investors: Buffett, Munger, and the Forgotten Investor

Back in the roaring '70s, this trio was poised to conquer Wall Street together. Warren Buffett, Charlie Munger, and a lesser-known figure named Rick Guerin. Guerin, managing his own fund called Pacific Partners, he worked closely with Buffett and Munger, acquiring stakes in promising companies.

Guerin's performance was nothing short of spectacular. From 1969 to 1983, his fund delivered a mind-boggling return of 22,000%, dwarfing the S&P 500's 316% over the same period. Buffett, recognized Guerin's talent, even included him in his prestigious "superinvestors" list in 1984.

But then, something strange happened. Guerin vanished from the investing world's radar, while Buffett and Munger went on to become legends. What went wrong?

"Charlie and I always knew we would become incredibly wealthy. We were not in a hurry... Rick was just as smart as us, but he was in a hurry. And so actually what happened, some of this is public... was that in the ’73, ’74 downturn, Rick was levered with margin loans. And the stock market went down almost 70% in those two years, and so he got margin calls out the yin-yang, and he sold his Berkshire stock to me."

During the brutal market downturn of 1973-74, Guerin's impatience proved costly. Heavily leveraged with margin loans, he was forced to sell his Berkshire Hathaway shares to Buffett for a mere ₱2,200 each when the market crashed. Those same shares today? Worth over ₱24,750,000 apiece (as of this writing).

This cautionary tale reminds us of a profound truth in investing:patience isn't just a virtue, it's a superpower. Buffett and Munger's slow, steady approach allowed them to weather storms and emerge stronger. Guerin's haste, despite his brilliance, cost him a place in investing history.

The Magic of Compound Growth

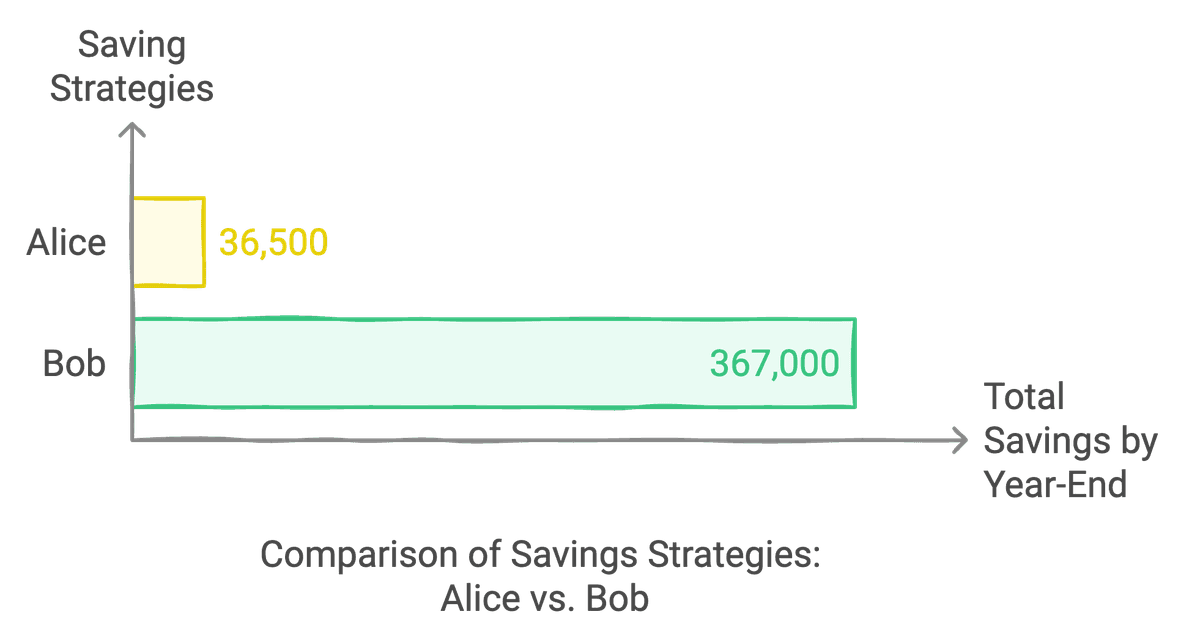

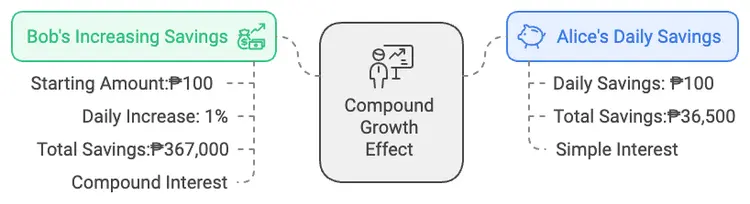

Let's dive deeper into the world of compound growth with a thought experiment that might just blow your mind. Meet Alice and Bob, two friends with very different saving strategies.

Alice decides to save ₱100 every single day for a year. It's a straightforward approach, and by December 31st, she'd have a tidy sum of ₱36,500. Not bad, right?

Now, let's look at Bob's strategy. He starts with ₱100 on day one, but each day, he increases his savings by just 1% of the previous day's amount.

- Day 1: ₱100

- Day 2: ₱101 (1% increase from ₱100)

- Day 3: ₱102.01 (1% increase from ₱101)

- Day 4: ₱103.03 (1% increase from ₱102.01)

- Day 5: ₱104.06 (1% increase from ₱103.03) ...and so on.

It seems like a tiny tweak, doesn't it? But here's where it gets wild. By the end of the year, Bob's savings wouldn't be ₱36,500 like Alice's. They wouldn't even be double that. Bob's total? An astounding ₱367,000!

This mind-bending result showcases the power of exponential growth. It's the same principle that turns a small snowball into an avalanche.

While Bob's approach might not be practical in real life (increasing savings by 1% daily is challenging), this example illustrates why the wealthy focus so heavily on investments that can compound over time. Even small percentage increases, when compounded, can lead to extraordinary results.

This principle applies to various aspects of real investing:

- Reinvesting dividends from stocks

- The growth of a diversified investment portfolio over decades

- The compounding effect of consistently adding to your investments

It's not just about how much you save, but how you allow your money to grow over time.

The Mesmerizing Magic of Compound Growth

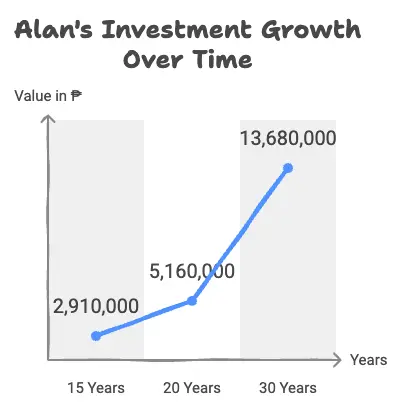

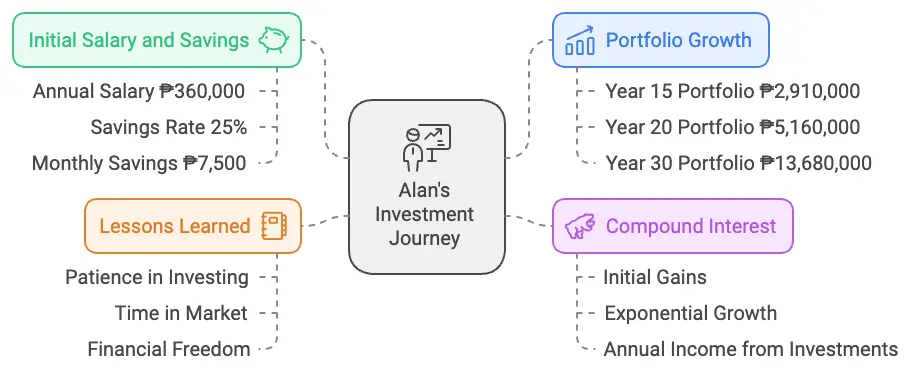

Now, let's meet Alan, in his 20s, earns salary of ₱360,000 per year. He decides to save 25% of his income, which is ₱90,000 annually, and invests it at a 10% annual return. For simplicity, let's assume his salary and savings rate stay constant.

In the early years, Alan's investment gains seem unremarkable. But patience is his secret weapon. Let's see how his portfolio grows over time:

Around year 15, something magical happens. Alan's portfolio value (₱2,910,000) surpasses his total savings (₱1,350,000). The power of compound interest is kicking in!

By year 20, while Alan has saved a total of ₱1,800,000, his portfolio has grown to ₱5,160,000. That's nearly three times what he's put in!

Fast forward to year 30, and Alan's portfolio is worth ₱13,680,000 – more than five times his total savings. His investments are now generating about ₱1,368,000 annually, which is nearly four times his original salary! Below is Alan's Investment Strategy

Don't get me wrong, I know it's not easy to find 10%, but this illustrates the power of compound growth. It's like a financial snowball that, given enough time, turns into an unstoppable force. It's why Einstein allegedly called compound interest the eighth wonder of the world.

Remember, in the world of investing, it's not about timing the market. It's about time in the market. Patience isn't just a virtue, it's your ticket to financial freedom.

💡 Grab a copy of Investment Thesis

Learn from those who've done it. Drop your email below 👇🏻

Download FREE Investment Thesis

Disclaimer

☕ My top tools for investment and personal development:

- ⏰ Timeboard: A simple productivity hack to help you achieve more in less time.

- 📈 The Financial Minimalist PH: The right way to master personal finance.

- 🔥 Commerce Playbook: Your cheat sheet for e-commerce. Launch your business in days, not months!

💻 Follow my journey to getting FIRE READY

Join 1000+ corporate rebels who are done playing by the old rules and steal how I start crafting my escape plan.

Get 10 hacks for free about personal finance, investment, and soloprenuer ideas.

I'd love to hear your corporate story! email me at thecorporateslavegotfired@gmail.com