The Real Deal About Emergency Funds

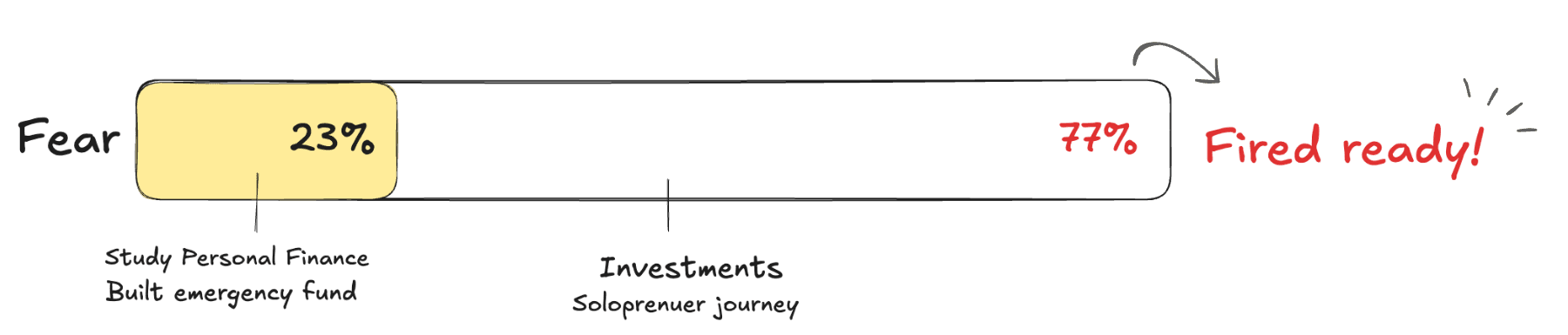

As of this writing, I've successfully built my emergency fund to cover a full 12 months of expenses!

that fills me with both pride and peace of mind. But I didn't stop there. I've immersed myself in the study of investments and proper asset allocations.

Let's rewind a bit...

It's just another Tuesday at the office. I'm sipping my second cup of coffee, checking my backlogs and tasks when suddenly, my boss calls an impromptu meeting. The air feels thick with tension as I go into the conference room. Then the announcement hits us, "I'm sorry, but we have to let you guys go."

In that moment, the weight of all my financial responsibilities crashes down on me, the mortgage I just started paying, the car loan, those credit card bills. It's like a financial shock, threatening to sweep away everything I've built. And to add fuel to the fire, that is August 29, 2019, exactly my birthday. I got fired instead of getting a cake, that is the worst birthday gift.

The False Sense of Security

Now, don't get me wrong. I wasn't completely unprepared. I had savings, and I knew the importance of an emergency fund. But did I truly understand it? Not even close. There were times I dipped into my emergency fund for a spur-of-moment vacation or an "can't-miss" investment opportunity. After all, my emergency fund was just sitting there in my savings account, not doing much. Using it seemed like a good idea at the time. How naive I was!

It's true when they say.. you only take things seriously when they hit you square in the face. And boy, did reality pack a punch.

The Harsh Reality Check

As soon as the shock of being fired wore off, my soul came back and I started crunching numbers. How long could I survive on my remaining emergency fund? The answer sent chills down my spine, a mere two months. Talk about a wake-up call!

Let me break it down for you. The basic formula for an emergency fund is 3-6 months of your total monthly expenses. So, if you're spending ₱80,000 a month, your emergency fund should be between ₱240,000 to ₱480,000. And if you can save 12 months' worth? You're good for a whole year without work.

I have a friend who had this 12-month cushion, and it was a lifesaver when the pandemic hit. Meanwhile, there I was, sweating bullets with my measly two-month buffer back then.

The Temptation and the Lesson

If you're anything like I was, thinking of creative ways to use your emergency fund when there's no real emergency, let me give you a piece of hard-earned advice: think again. Once you've felt the cold sweat of being blindsided by bills, you'll be grateful for every peso in that fund.

I consider myself lucky. I didn't have to resort to taking out high-interest loans just to keep the lights on. But mind you, the thought of compound interest working against me instead of for me? That's the stuff of financial nightmares.

The Road to Recovery

After I miraculously landed a new job, I made a solemn vow to myself. I would replenish my emergency fund and keep it liquid enough for real emergencies. Every morning as I head to work, I remind myself: "This could be my last day here." It's not pessimism, it's realism. And it sure keeps me from spending that emergency fund on non-emergencies!

The Balancing Act

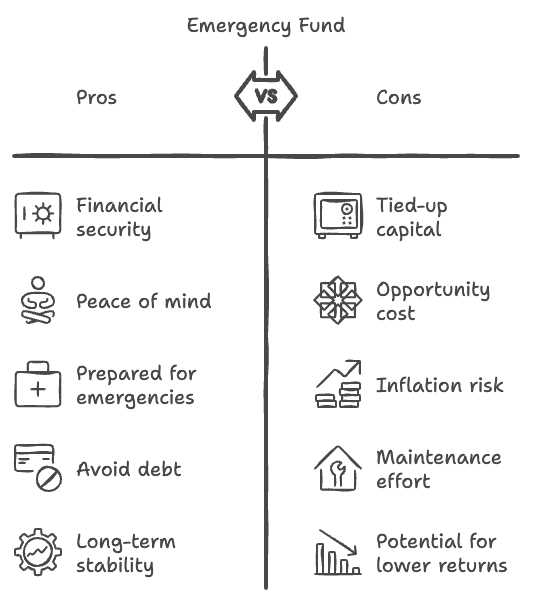

Now, I know what you're thinking. "But isn't it a waste to have all that money just sitting in a savings account?" You're not wrong. The opportunity cost of parking money in a low-interest savings account can be painful, especially when you understand the power of compound interest.

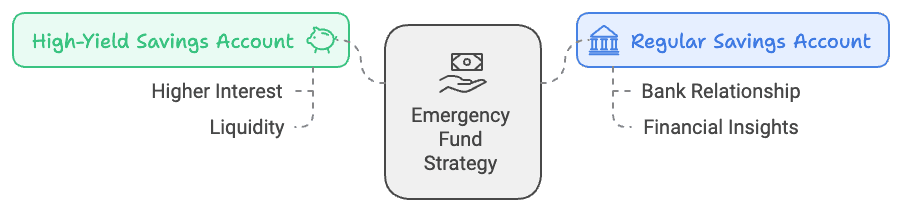

So, here's what I did. I split my emergency fund in two: half goes into a high-yield savings account, and the other half stays in a regular savings account with a relationship manager. This way, I'm earning a bit more interest while also maintaining a relationship with the bank that keeps me informed about forex rates, bond offers, and low-interest loan opportunities. Remember, good relationships with the bank can be investments too!

The Birth of "The Corporate Slave" Blog

After this experience, I told myself, I need something that will give me that security and freedom. I need to be financially independent, so that when the day comes my new boss fires me again, there are no flashback bills or heavy weight because I am ready. I will continue to work but not for my boss, for myself. The "workaholic me" is now transformed into getting out of this rat race and I will document my journey on this blog. Dig deeper into personal finance, investments and try to start the journey of solopreneurship.

The Wake-Up Call Question

The next time you're tempted to dip into your emergency fund for that dream vacation or that enormous flat-screen TV, pause for a moment. Ask yourself this: "What would I do if my boss told me I was being fired today?"

Let that question be your North Star, guiding your financial decisions. Because in this unpredictable world, it's not a matter of if an emergency will happen, but when. And when it does, you'll be thanking your past self for having the foresight to be prepared.

Remember, an emergency fund isn't just a financial cushion, it's peace of mind. It's the difference between facing a setback with confidence and facing it with panic. So, build that fund, protect it fiercely, and sleep better knowing you're ready for whatever curveballs life might throw your way.

Your future self will thank you. Trust me, I know.

Important

☕ My top tools for investment and personal development:

- ⏰ Timeboard: A simple productivity hack to help you achieve more in less time.

- 📈 The Financial Minimalist PH: The right way to master personal finance.

- 🔥 Commerce Playbook: Your cheat sheet for e-commerce. Launch your business in days, not months!

💻 Follow my journey to getting FIRE READY

Join 1000+ corporate rebels who are done playing by the old rules and steal how I start crafting my escape plan.

Get 10 hacks for free about personal finance, investment, and soloprenuer ideas.

I'd love to hear your corporate story! email me at thecorporateslavegotfired@gmail.com